Multi-million dollar fleet decisions shouldn’t be made on speed-taped data

BladeStack gives aviation decision-makers fast, visual, serial-number-specific clarity on the value, maintenance exposure, and lifecycle risk of their aircrafts— without spreadsheets, brokers, or manual models.

The aviation market is bigger, older and harder to read than ever.

Thousands of aircraft sit on the market for 300+ days before moving. That’s billions in industry capital tied up, and you can feel it—deals stall, fleets age, and every decision gets more expensive.

And who takes the hit? Operators, investors, and analysts—left answering the same million-dollar question: Is this asset worth it, or are we about to get burned?

Problem is, the “tools” they depend on are a mess. OEM price lists, PDF manuals, siloed spreadsheets, and “expert” opinions patched together with tribal knowledge.

It’s slow. It’s risky. And it doesn't scale.

BladeStack is built for this exact moment.

Meet BladeStack

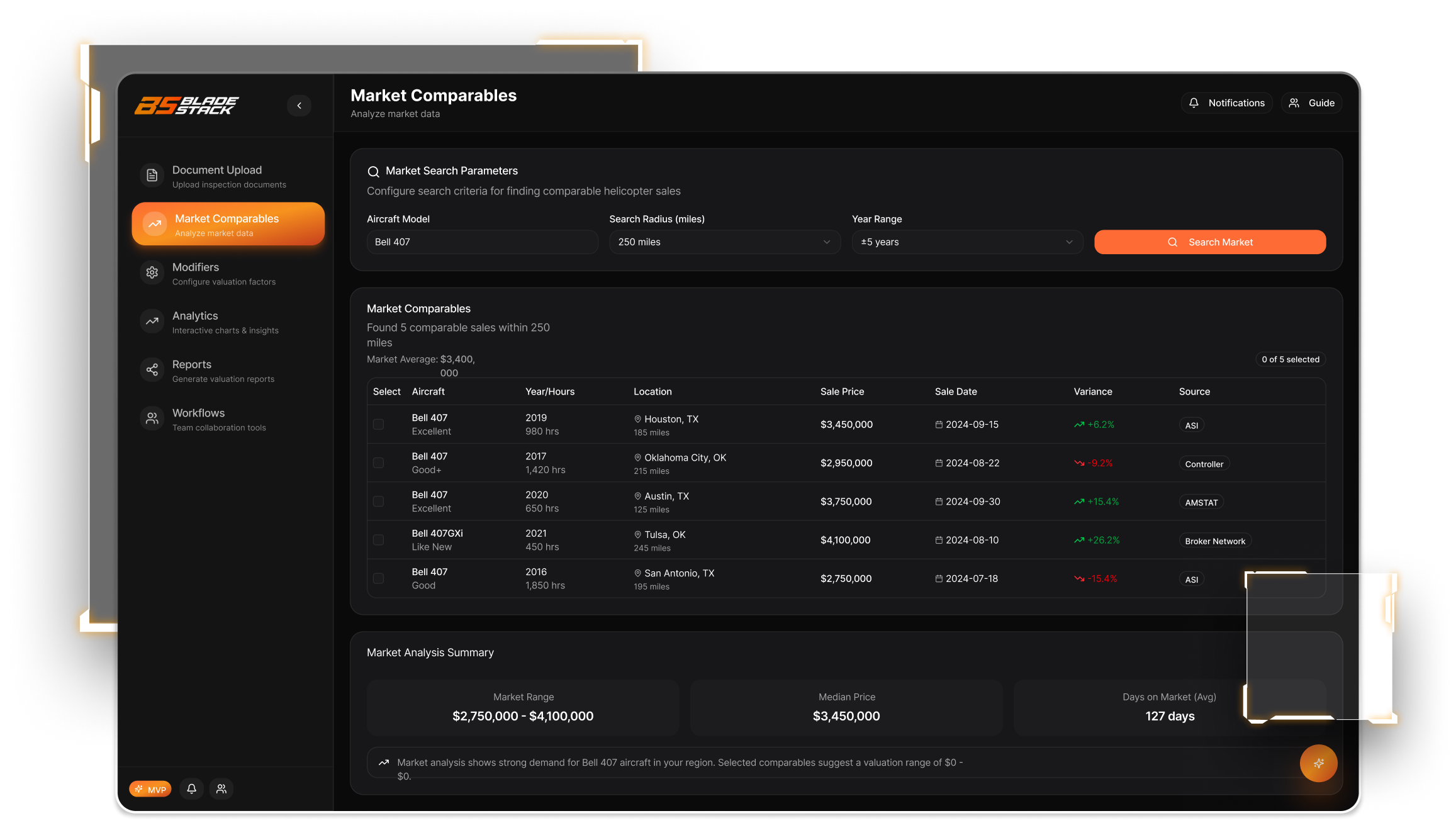

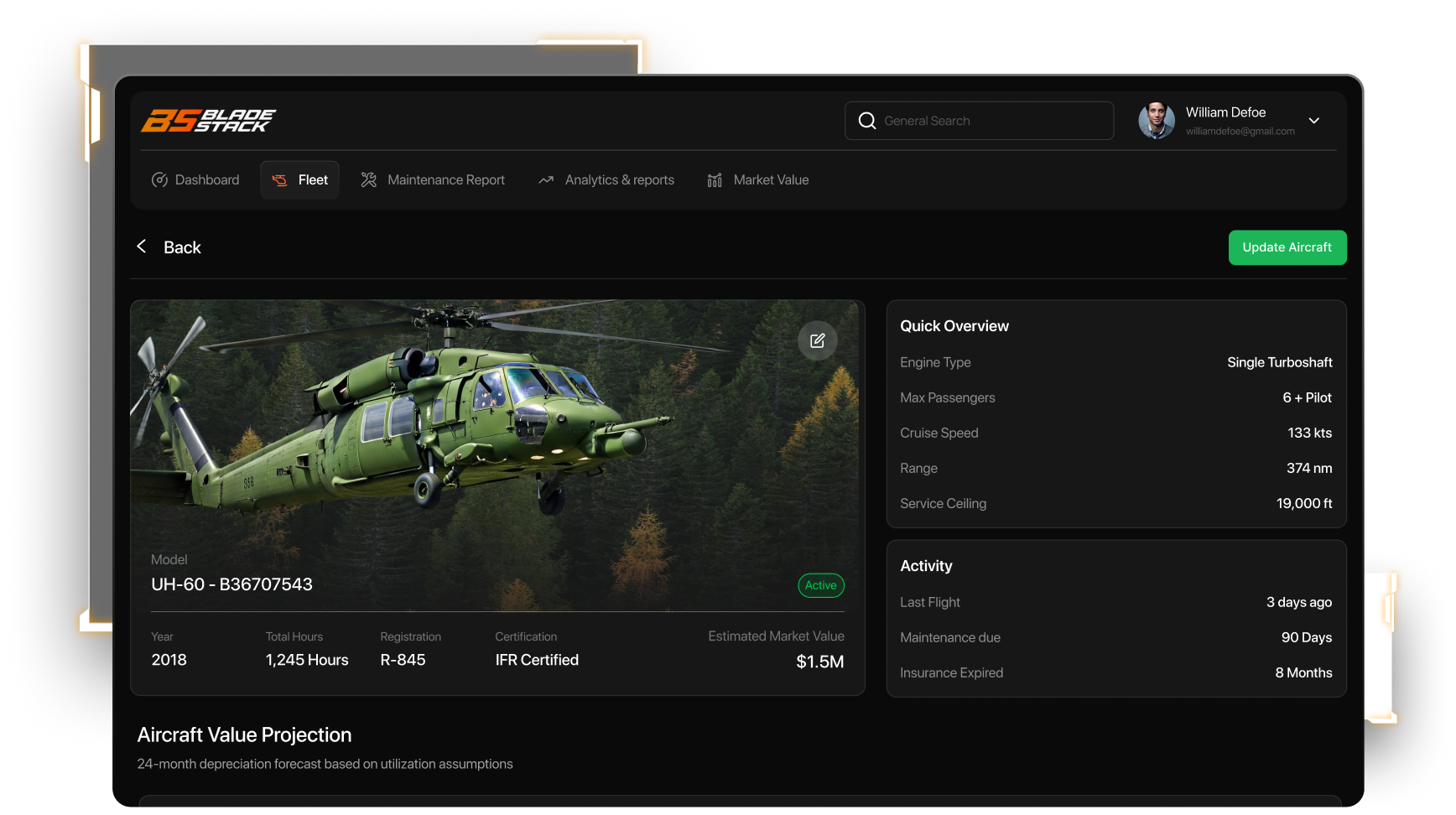

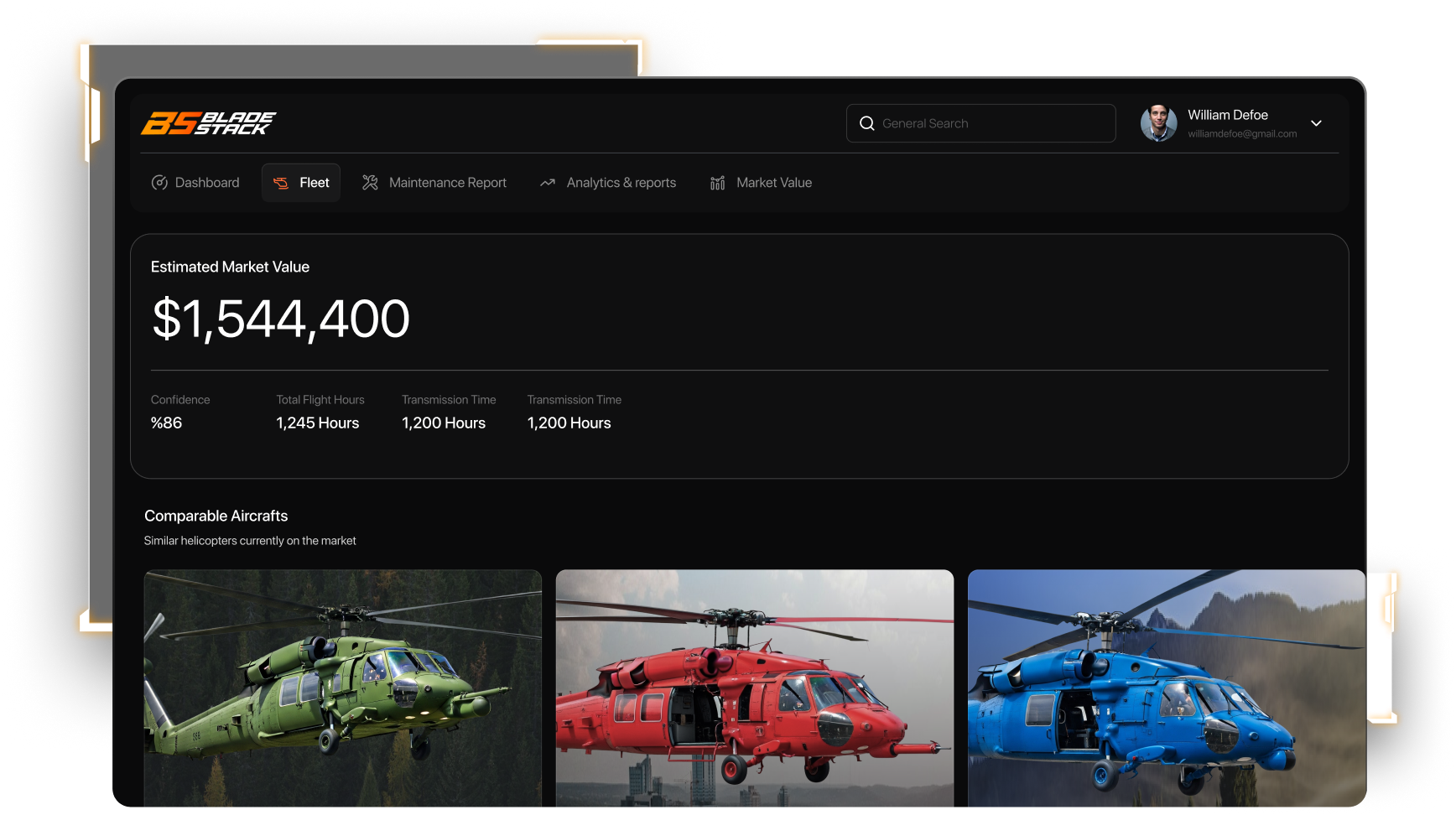

BladeStack turns messy aircraft records into visual, defensible valuations powered by real market data.

In a few clicks, operators, brokers, and investors can see what an aircraft is worth, what it will cost to run, and when it will break even.

Think Bloomberg Terminal, but for helicopters.

It flips the question from “Do we really know what we’re buying?” to “Here’s the risk, value, and ROI” in under an hour.

Valuation clarity, risk forecasting, and lifecycle intelligence

all in one clean dashboard.

Visual, Executive-Friendly Dashboards

Get one clean dashboard with interactive graphs, clear timelines, and a shared view built for both finance pros and technical SMEs. Everyone sees the same picture, so decisions get made faster.

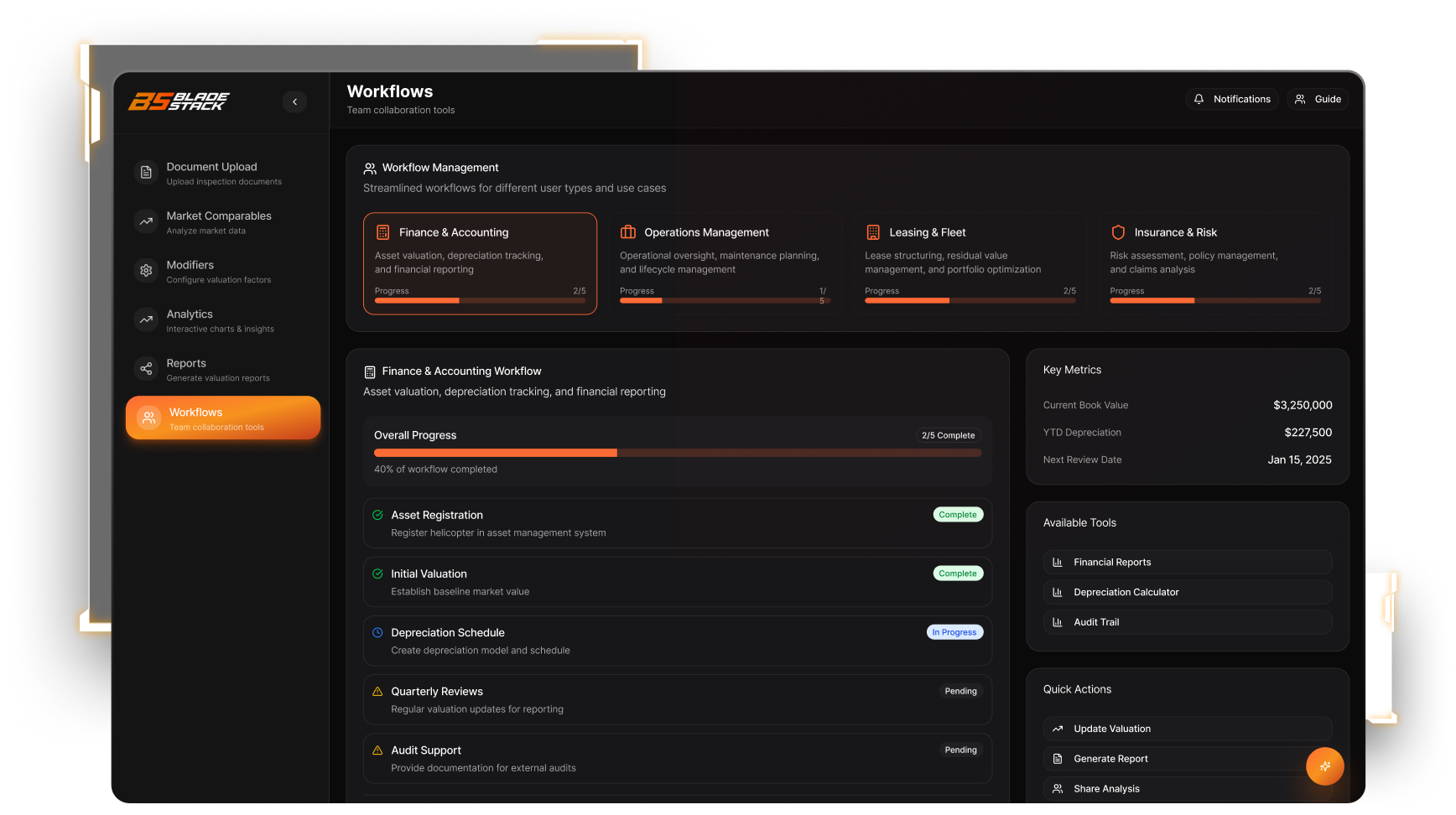

Dynamic Lifecycle & Financial Scenarios

Test the "what ifs" in minutes, not days. Model lease terms, ROI, and CapEx over 1-20 years with flexible assumptions.

Export polished, boardroom-ready visuals to back your case with lenders, boards, or exec teams.

AI Powered Insight Cards

Make the call without drowning in data. Insight Cards pull the story behind the numbers—summarizing risk, ROI, and exposure at a glance.

Instead of drowning in rows of data, execs and SMEs get a clear read on what matters most. Whether it's a looming maintenance hit, a swing in residual value, or the true break-even horizon, you get the headline facts fast.

Component-level Lifecycle Modeling

See every moving part, not just a rough valuation. Each aircraft is rebuilt at the component level with structured data—mapping hours, part numbers, usage, and overhaul schedules into one interactive timeline. Spot hidden exposure, avoid depreciation surprises, and protect $250K+ on bids.

All your aircraft data.

One dashboard. No spreadsheets.

Where finance, ops, and aviation data finally meet in one clean view.

When the CFO and the DOM are looking at the same numbers — smarter calls get made faster.

Fleets get more profitable. Deals move faster.

Risk gets smaller. The playing field levels.

Save time and money

Cut 10+ hours of spreadsheet work per evaluation. That’s $10K–$15K in labor or consultant fees you don’t have to burn.

Reduce risk

See the hidden factors that can sink a deal. Catch them early and protect $250K+ on bids.

Optimize capital

Run ownership vs. lease vs. part-out scenarios in minutes to make smarter $1M+ allocation calls.

Speed up appraisals

Cut weeks off the appraisal process with clean, transparent modeling.

Align with everyone

No more arguing over whose numbers are right. Execs, ops, and brokers all work off the same view.

Plan smarter

Turn aircraft usage into clear demand forecasts so you can line up inventory, avoid shortages, and cut down on expensive surprises.

Move faster at auction

Go from raw records to a defensible valuation in 3 clicks (literally) so you can bid with confidence.

Build trust

Every model is transparent and traceable, so banks, boards, and buyers can see how you got there. Approvals land faster, and the heat is off your judgment calls.